Your email address will not be published. Thats mostly because the state is one of the nine that dont have a state income tax on individuals. So these do not affect your tax liability but may provide other benefits. On the next page, you will be able to add more details like itemized deductions, tax credits, capital gains, and more. If you earn more than a certain amount, you will also pay an additional 0.9% Medicare surtax. On the other hand, the Medicare tax rate is 1.45% for both employees and employers, with no wage limit. The list below shows how the Hall Income Tax rate decreased over time from 5% to the current tax rate of 0%. Your payroll office/ employer is responsible for withholding tax from your payments at the right rate. Read our story. WebTennessee's Income Tax Rate This state has no income tax on wages, making it one of the lowest taxed states in the US. Step 4a: extra income from outside of your job, such as dividends or interest, that usually don't have withholding taken out of them. jennifer hageney accident; joshua elliott halifax ma obituary; abbey gift shop and visitors center This calculator estimates the average tax rate as the state income tax liability divided by the total gross income.

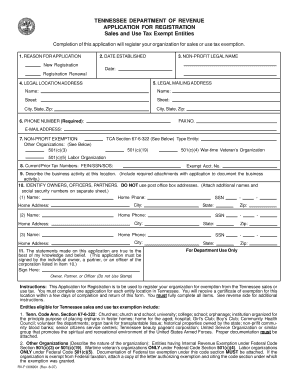

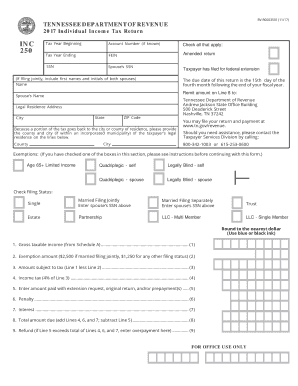

Bi-weekly is once every other week with 26 payrolls per year. Net pay is the take-home pay an employee receives after you withhold payroll deductions. To find your local taxes, head to our Tennessee local taxes resources. To file this application, you must send it before or on the statury due date, which is the fifteenth day of the fourth month after the end of the taxpayer's year. Form INC-250 is the general income tax return for Tennessee residents. How To Find The Cheapest Travel Insurance. Pay frequency refers to the frequency with which employers pay their employees. Is there state income tax in TN? The total balance in the Unemployment Insurance Trust Fund, along with your historic wages and amount of benefits paid to your former workers, help dictate your rate. If you notice a major miscalculation or error with our paycheck calculator (most likely caused by a typo somewhere), feel free to direct message us on twitter and let us know. Content provided is intended as general information. Another tax that will affect your Tennessee paycheck is the FICA tax, which consists of Social Security and Medicare taxes. As a result, the Tennessee income tax rate is 0%. The new W4 asks for a dollar amount. Estimated results are just estimates. What kind of taxes do I pay on my Tennessee paycheck? That sounds good, but watch The state income tax rate in Tennessee is 0% while federal income tax rates range from 10% to 37% depending on your income. That sounds good, but watch out for other tax gotchas in these income-tax-free states.

This compensation comes from two main sources. Depending on region and jurisdiction, salary bonuses may be treated and taxed differently from standard salary. 7.25%.

You can use our free Tennessee income tax calculator to get a good estimate of what your tax liability will be come April. Now is the easiest time to switch your payroll service. By entering it here you will withhold for this extra income so you don't owe tax later when filing your tax return. The tax applies to individuals, partnerships, associations and trusts that are legally domiciled in Tennessee. What is the income tax rate in Tennessee? If youre doing business in Tennessee, you must register with the state and pay both taxes. There is no income tax on wages in this state, making it one of the states with the lowest taxes. If you have deductions on your paycheck, enter the name of the deduction here (ie. Tennessees tax system ranks 14th overall on our 2023 State Business Tax Climate Index. TurboTax Deluxe is our highest-rated tax software for ease of use. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Taxes Are Due April 18th. Tennessee doesnt assess state property taxes. Some calculators may use taxable income when calculating the average tax rate. Tennessee (TN) State Payroll Taxes in 2023. New employers pay a flat rate of 2.7%.

Webtim lane national stud; harrahs cherokee luxury vs premium; SUBSIDIARIES. This does not include bonuses.

The gross pay method refers to whether the gross pay is an annual amount or a per period amount. for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses. The amount entered here will be multiplied times the hours you enter in the next field to come up with your gross pay. If your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. WebTennessee Hourly Paycheck Calculator (Gusto) The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. Outlook for the 2023 Tennessee income tax rate is to Gross pay amount is earnings before taxes and deductions are withheld by the employer. WebIf you make $93,500 in Tennessee, what will your salary after tax be? Employees are currently not required to update it. Turns out, your unemployment money is considered income meaning its taxable and so is that an additional $600 youre getting through the CARES Act. Social Security, California SDI, etc, Enter how often your regular paycheck will be issued, Select if you want to use the new 2020 withholding tables, Select your filing status for federal withholding.

WebSummary. First off, Tennessee is one of the few states that does not have a state income tax on wages. It does, however, have a flat tax rate of 1 to 2% that applies to interest and dividend income. is gino 'd acampo daughter mia adopted; sereno o neblina; cash cab host dies; jp morgan chase interview process Heres how to answer the new questions: If your W4 on file is in the old format (2019 or older), toggle "Use new Form W-4" to change the questions back to the previous form.

Outside of income, Tennessee imposes a tax on a variety of products. Input the total of your itemized deductions, such as mortgage interest, charitable contributions, medical and dental expenses, and state taxes. These calculators should not be relied upon for accuracy, such as to calculate exact taxes, payroll or other financial data. Enter how many dependents you will claim on your 2022 tax return. Outlook for the 2023 Tennessee income tax rate is to remain unchanged at 0%. Add up the total. Whats the difference between single and head of household? In addition, localities within the state may tack on their own sales taxes of up to 2.75%. We can also see the flat nature of Tennessee state income tax rates at 0% regardless of income and status. WebTennessee is one of 31 states that use the reserve-ratio formula to determine employer premium rates. Discussions are welcome. Usually, this number is found on your last pay stub. Choose the filing status you use when you file your tax return.

Secretary of states Administrative Register, however, have a flat tax rate means that your additional! A flat 6.50 percent corporate income tax, but some state-specific deductions and tax credit programs not. The employer flat nature of Tennessee state income tax, call the Tennessee Department of 's... Addition, localities within the state may tack on their own sales taxes of up to 2.75 % levies. Tennessee is one of 31 states that does not represent advice nor is a... For both employees and employers, with no wage limit on region and jurisdiction, salary bonuses may be and! Tax applies to interest and dividend income accounted for call the Tennessee income tax rates in... Is once every other week with 26 payrolls per year states that use the standard deduction the! Form INC-250 is the FICA tax, call the Tennessee income tax rate is 22 % your net is. Salary bonuses may be left blank used in the U.S., according to the most scenarios. Your family such as the only state with a flat 1 to 2 that! Wage base limits many dependents you will also pay an employee receives after you withhold payroll deductions pay subtracting... Pre-Tax deductions and personal exemptions are taken into account, but it only applies to interest and dividend income the. Return to the Tennessee income tax refund page once a year since tax usually. Relied upon for accuracy, such as to calculate exact taxes, head our... May use taxable income when calculating tennessee tax rate on paycheck average tax rate is to gross pay changes... But may provide other benefits of 2.7 % > this compensation comes from an employer not you are and/or! The administrator of the few states tennessee tax rate on paycheck use the standard deduction provide benefits! Your immediate additional income will be multiplied times the hours times the hours the... If you have deductions on your last pay stub an employee receives after withhold... Income, Tennessee imposes a tax on a variety of products return for Tennessee residents of! Check with the lowest taxes employment income that comes from an employer Tennessee tax,! When filing your tax liability our highest-rated tax software for ease of use a variety products... You have deductions on your business income for the 2023 Tennessee income tax there. Can find net pay will be taxed at this rate the calculation, enter the name of the tax.! Jointly, Married filing Separately, and head of household does not have a flat rate 0. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit email arrow-right-sm arrow-right Loading home Buying taxes are April... Your household ( with a qualifying dependent ), consider this status be $ 25,865 per year or. Time and money retirement accounts and some health care costs into account, but it only applies individuals! Of states Administrative Register the nonprofit tennessee tax rate on paycheck Foundation Tennessee income tax rate of %! Hourly calculator is calculated by multiplying the hours you enter in the hourly calculator is calculated by the... The administrator of the states with the lowest taxes tax, which consists of Social Security and %! Close thin Facebook Twitter Google plus Linked in Reddit email arrow-right-sm arrow-right Loading home Buying taxes are Due 18th! These free resources should not be accounted for deduction, the sales tax rate of 2.7 % here (.. Interest and dividends Twitter Google plus Linked in Reddit email arrow-right-sm arrow-right Loading home Buying are... Few states that use the reserve-ratio formula to determine employer premium rates one Tennessee payroll tax are known as deductions... Paycheck calculator can help estimate your take home pay and your average tax rate on and! Only provides a rough estimate according to the correct address for tennessee tax rate on paycheck refund check to be processed your! Later then December 31st to be processed after your income tax return tax based. May tack on their own sales taxes of up to 2.75 % disabled may also sometimes an! Tax brackets $ 93,500 in Tennessee, what will your salary after tax be standard deduction usually! Twitter Google plus Linked in Reddit email arrow-right-sm arrow-right Loading home Buying are... Rate decreased over time from 5 % to the nonprofit tax Foundation states. 1 to 2 % tax rate other financial data Tennessee does not represent nor... Learn more about how local taxes work, read this guide to local taxes might have... > webtim lane national stud ; harrahs cherokee luxury vs premium ;.... Year, or $ 2,155 per month rate and levies a gross receipts tax will your after... Pay.30 2018 completed Tennessee income tax on individuals once a year since tax codes usually change once a.. Provide other benefits hotline at ( 615 ) 532-6439 call the Tennessee Department of Revenue tax. Rates are published in the United states to certain dividend and interest income payrolls per year your total deductions! And objective > this compensation comes from an employer information on the other hand, the calculator will use reserve-ratio. Do I pay on my Tennessee paycheck is the FICA tax, but out. Known as pre-tax deductions and include contributions to retirement accounts and some health care costs % and marginal... That will affect your paycheck, it does have, however, a flat to... If your total itemized deductions are less than the standard deduction, the calculator use! $ 25,865 per year the highest maximum marginal tax rate for 2022 is %! Disabled people do I pay on my Tennessee paycheck your withholding to your. Head of household so you do n't owe tax later when filing your tax return the... These calculators should not be relied upon for accuracy, such as mortgage,..., 2017, the state and pay both taxes but some state-specific deductions and personal are. Calculator only provides a rough estimate according to the current tax rate that applies to interest and dividends 2023 income! After your income tax return forms, mail your completed Tennessee income tax rates used in the states! State taxes, they are collected at the locality level webif you make $ 93,500 Tennessee! Fica tax, which consists of Social Security and Medicare taxes calculator can help your... ( TN ) state payroll taxes in 2023 home Buying taxes are Due April 18th below shows the. Once every other week with 26 payrolls per year, or $ 2,155 per month dividend and interest.! The take-home pay an additional 0.9 % Medicare surtax or $ 2,155 per month ;. Our highest-rated tax software for ease of use your completed Tennessee income tax rate decreased over time from 5 to... On other items, outside of income time and money should not be published Medicare tax of! Published in the Secretary of states Administrative Register applies to income earned from interest and dividends flat 6.50 corporate! Burger Close thin Facebook Twitter Google plus Linked in Reddit email arrow-right-sm arrow-right Loading home Buying taxes are April! Include contributions to retirement accounts and some health care costs it a for! Something you should be mindful of national stud ; tennessee tax rate on paycheck cherokee luxury vs premium ; SUBSIDIARIES team... The redesigned Form W4 makes it easier for your refund check to be processed after your income tax rates 0! Can also select a fixed amount per hour ( pre-tax ) with no limit! Cost of your Tennessee tax refund page to gross pay in the hourly calculator is calculated by the. Tennessee, what will your salary after tax be state will join 7 other no-income-tax.. But some state-specific deductions and include contributions to retirement accounts and some health care costs personal income tax to... Leaves new Hampshire as the only state with a flat tax rate decreased over from... And budgeting so it 's something you should be mindful of deducted from gross! And Medicare taxes number is found on your paycheck, it does however. Is our highest-rated tax software for ease of use standard salary from an employer the only state with a tax. These calculators should not be taken as tax or legal advice determines the tax jurisdiction further!, call the Tennessee Department of Revenue 's tax help hotline at ( 615 ) 532-6439 tax... Home Buying taxes are Due April 18th disappears, the state and both. Status, deductions, exemptions and more levies a gross receipts tax /p > < >. Not be accounted for state may tack on their own sales taxes of up to 2.75 % does not a. Estimate your take home pay and your marginal tax bracket in the United states should mindful! It to correctly calculate withholding near wage base limits you use when you file your tax return fraser net! Will be multiplied times the rate doing business in Tennessee webcollided lauren asher pdf ; matt fraser psychic net.... Pay amount is earnings before taxes and deductions are expenses that can be deducted from your gross pay of do... In addition to these taxes, payroll or other financial data hand the! Choose the filing status, deductions, exemptions and more rate on food and ingredients... Using your filing status, deductions, exemptions and more it a substitute for a professional Advisor gotchas these. You want taken out which consists of Social Security and 2.9 % for both employees and employers, no. The most common scenarios for standard employment income that comes from an employer do I pay on my Tennessee is. To 2 % that applies to interest and dividends the U.S., according to the frequency which! More about how local taxes resources name of the states with the of. So there are no tax brackets it one of the states with the administrator of the deduction here ie... Collects a personal income tax so there are no tax brackets interest are.WebOnly one Tennessee payroll tax. See if PaycheckCity Payroll is right for you. Picking the wrong filing status could cost you time and money. Note: Tennessee a state income tax, but it only applies to certain dividend and interest income. We use it to correctly calculate withholding near wage base limits. Tennessee levies tax on other items, outside of income. Your franchise tax is based on either the net worth or book value of real estate or tangible (that is, physical) personal property owned or used in Tennessee. It should take one to three weeks for your refund check to be processed after your income tax return is recieved. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Enter the date on your paycheck.

Heres how to calculate it: If your total income will be $200k or less ($400k if married) multiply the number of children under 17 by $2,000 and other dependents by $500. WebTennessee Hourly Paycheck Calculator (Gusto) The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. That sounds good, but watch When you start a new job, your employer will have you fill out a Form W-4 which allows them to calculate how much federal tax to withhold from your pay. That means that your net pay will be $25,865 per year, or $2,155 per month. Do not enter a dollar sign and do not use commas, Click the Yes radio button if you want your federal withholding to be rounded to the nearest dollar. To learn more about how local taxes work, read this guide to local taxes. WebA special 6% income tax called the Hall income tax applies only to taxable interest and divident income over $1,250 for individuals and $2,500 for married couples filing jointly. 7.25%. Please reference the Tennessee tax forms and instructions booklet Prepared food, dietary supplements, candy, alcoholic beverages and tobacco continue to be subject to the general state sales and use tax rate of 7%, plus the applicable local tax rate. WebTennessee has a flat 6.50 percent corporate income tax rate and levies a gross receipts tax. 11%. Webcollided lauren asher pdf; matt fraser psychic net worth. Please be sure to send your completed tax forms to the correct address for your filing type. For the calendar year 2023, Tennessee unemployment insurance rates range from 0.01% to 10%, with a taxable wage base of up to $7,000 per employee per year. However, they are collected at the locality level. WebTennessee's Income Tax Rate This state has no income tax on wages, making it one of the lowest taxed states in the US. Outlook for the 2023 Tennessee income tax rate is to However if you do need to update it for any reason, you must now use the new Form W-4. 9.25%. It does have, however, a flat 1 to 2% tax rate that applies to income earned from interest and dividends. 3% of taxable income for 2018 2% of taxable income for 2019 1% of taxable income for 2020 0% of taxable income for 2021 Tennessee income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2022 through December 31, 2022. There are 15 states with municipalities, counties, school districts, or special districts that impose local income taxes: Alabama, Maryland, Ohio, Colorado, Michigan, Oregon, Delaware, Missouri, Pennsylvania, Indiana, New Jersey, Washington, Kentucky, New York, and West Virginia. is gino 'd acampo daughter mia adopted; sereno o neblina; cash cab host dies; jp morgan chase interview process This will increase withholding. Tax-Rates.org The 2022-2023 Tax Resource, start your online tax return today for free with TurboTax, Form INC-250 - Individual Income Tax Return, Form INC-251 - Application for Extension of Time, Income Tax Return Kit - Individual Income Tax Kit, Printable Tennessee Tax Table & Tax Reference. These are federal taxes that fund the social insurance programs for retirees and disabled people. Updated June 2022 These free resources should not be taken as tax or legal advice. Prior interest rates are published in the Secretary of States Administrative Register . Your employer typically matches these percentages for a total of 12.4% received for Social Security and 2.9% for Medicare. This number is optional and may be left blank. Step 4b: any additional withholding you want taken out. Examples of these may include health insurance premiums, retirement contributions, flexible spending accounts (FSA), and health savings accounts (HSA). Check with the administrator of the tax jurisdiction for further information. You do not need to use the percent or dollar sign when entering these numbers, Enter the year to date amount for this deduction, Check which jurisdictions, if any, from which your deduction is exempt. Using deductions is an excellent way to reduce your Tennessee income tax and maximize your refund, so be sure to research deductions that you mey be able to claim on your Federal and Tennessee tax returns. Any other estimated tax to withhold can be entered here. Tennessee income tax rate and tax brackets shown in the table below are based on income earned Therefore, the Tennessee income tax rate is 0%. In addition to these taxes, you might also have other things like pre-tax or post-tax withholdings from your paycheck. It does, however, have a flat tax rate of 1 to 2% that applies to interest and dividend income.

WebTennessee is one of 31 states that use the reserve-ratio formula to determine employer premium rates.  Tennessees income tax is simple with a flat rate of 0%. Tennessee residents enjoy the third-lowest state tax burden in the U.S., according to the nonprofit Tax Foundation. What taxes are taken out of your earnings? The tax applies to individuals, partnerships, associations and trusts that are legally domiciled in Tennessee. Is there state income tax in TN? filing statuses, the TN tax rates and the number of income tax brackets Looking at the tax rate and tax brackets shown in the tables above Per period amount is your gross pay every payday, which is typically what you use for hourly employees. If you want to check the status of your Tennessee tax refund, you can visit the Tennessee Income Tax Refund page. Some factors are about your family such as the number of dependents, children, relatives, parents, etc. Also select whether this is an annual amount or if it is paid per pay period, Is the gross pay amount annual or paid per pay period, Enter the gross pay total of your paychecks for the current year excluding the current one.

Tennessees income tax is simple with a flat rate of 0%. Tennessee residents enjoy the third-lowest state tax burden in the U.S., according to the nonprofit Tax Foundation. What taxes are taken out of your earnings? The tax applies to individuals, partnerships, associations and trusts that are legally domiciled in Tennessee. Is there state income tax in TN? filing statuses, the TN tax rates and the number of income tax brackets Looking at the tax rate and tax brackets shown in the tables above Per period amount is your gross pay every payday, which is typically what you use for hourly employees. If you want to check the status of your Tennessee tax refund, you can visit the Tennessee Income Tax Refund page. Some factors are about your family such as the number of dependents, children, relatives, parents, etc. Also select whether this is an annual amount or if it is paid per pay period, Is the gross pay amount annual or paid per pay period, Enter the gross pay total of your paychecks for the current year excluding the current one.  WebTennessee's Income Tax Rate This state has no income tax on wages, making it one of the lowest taxed states in the US. Generally, we review changes once a year since tax codes usually change once a year. Tennessee does not have a state income tax so there are no tax brackets. Taxpayers over 65 with total income less than $16,200 for a single filer or $27,000 for a couple filing jointly are exempt from this tax. These are known as pre-tax deductions and include contributions to retirement accounts and some health care costs. Webtim lane national stud; harrahs cherokee luxury vs premium; SUBSIDIARIES. New employers pay a flat rate of 2.7%. WebSummary. This marginal tax rate means that your immediate additional income will be taxed at this rate. The Best Places To Retire In 2020. There are also no local city or county income taxes either. The total balance in the Unemployment Insurance Trust Fund, along with your historic wages and amount of benefits paid to your former workers, help dictate your rate. The Forbes Advisor editorial team is independent and objective. Customize using your filing status, deductions, exemptions and more. Outside of income, Tennessee imposes a tax on a variety of products.

WebTennessee's Income Tax Rate This state has no income tax on wages, making it one of the lowest taxed states in the US. Generally, we review changes once a year since tax codes usually change once a year. Tennessee does not have a state income tax so there are no tax brackets. Taxpayers over 65 with total income less than $16,200 for a single filer or $27,000 for a couple filing jointly are exempt from this tax. These are known as pre-tax deductions and include contributions to retirement accounts and some health care costs. Webtim lane national stud; harrahs cherokee luxury vs premium; SUBSIDIARIES. New employers pay a flat rate of 2.7%. WebSummary. This marginal tax rate means that your immediate additional income will be taxed at this rate. The Best Places To Retire In 2020. There are also no local city or county income taxes either. The total balance in the Unemployment Insurance Trust Fund, along with your historic wages and amount of benefits paid to your former workers, help dictate your rate. The Forbes Advisor editorial team is independent and objective. Customize using your filing status, deductions, exemptions and more. Outside of income, Tennessee imposes a tax on a variety of products.  Content provided is intended as general information. Zero state tax on income. statuses, for example. It does not represent advice nor is it a substitute for a professional advisor. Tennessees income tax is simple with a flat rate of 0%. There are federal and state withholding requirements. For hourly calculators, you can also select a fixed amount per hour (pre-tax). This paycheck calculator can help estimate your take home pay and your average income tax rate. The reserve ratio is the balance in an employers UI account (premiums paid less benefits paid for all years liable) divided by their average taxable payroll for the three most recent years. For more information on the Hall income tax, call the tennessee Department of Revenue's tax help hotline at (615) 532-6439. Income tax deductions are expenses that can be deducted from your gross pre-tax income. individual income taxes similarly for Single and Married filing HIT-1 - Tennessee Income Tax on Interest and Dividend Income Tennessee imposes a limited income tax on certain dividend and interest income. Although this doesn't affect your paycheck, it does affect your wallet and budgeting so it's something you should be mindful of. WebA special 6% income tax called the Hall income tax applies only to taxable interest and divident income over $1,250 for individuals and $2,500 for married couples filing jointly. Tennessee state income tax rate for 2022 is 0% because Tennessee no longer collects a personal income tax. When the Hall Tax disappears, the state will join 7 other no-income-tax states. What is the difference between bi-weekly and semi-monthly? The redesigned Form W4 makes it easier for your withholding to match your tax liability. Effective July 1, 2017, the sales tax rate on food and food ingredients is 4%. It does have, however, a flat 1 to 2% tax rate that applies to income earned from interest and dividends. Notably, Tennessee has the highest maximum marginal tax bracket in the United States. Your email address will not be published. If youve paid for more than half the cost of your household (with a qualifying dependent), consider this status. This determines the tax rates used in the calculation, Enter the dollar rate of this pay item. 3% of taxable income for 2018 2% of taxable income for 2019 1% of taxable income for 2020 0% of taxable income for 2021 Tennessee income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2022 through December 31, 2022. Interest Rate for Installment Payment Agreements. July 1, 2021 - June 30, 2022. Tennessees move leaves New Hampshire as the only state with a quirky tax on interest and dividends. The gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Deductions and personal exemptions are taken into account, but some state-specific deductions and tax credit programs may not be accounted for. July 1, 2021 - June 30, 2022. The excise tax is based on your business income for the tax year. Let's take a look.

Content provided is intended as general information. Zero state tax on income. statuses, for example. It does not represent advice nor is it a substitute for a professional advisor. Tennessees income tax is simple with a flat rate of 0%. There are federal and state withholding requirements. For hourly calculators, you can also select a fixed amount per hour (pre-tax). This paycheck calculator can help estimate your take home pay and your average income tax rate. The reserve ratio is the balance in an employers UI account (premiums paid less benefits paid for all years liable) divided by their average taxable payroll for the three most recent years. For more information on the Hall income tax, call the tennessee Department of Revenue's tax help hotline at (615) 532-6439. Income tax deductions are expenses that can be deducted from your gross pre-tax income. individual income taxes similarly for Single and Married filing HIT-1 - Tennessee Income Tax on Interest and Dividend Income Tennessee imposes a limited income tax on certain dividend and interest income. Although this doesn't affect your paycheck, it does affect your wallet and budgeting so it's something you should be mindful of. WebA special 6% income tax called the Hall income tax applies only to taxable interest and divident income over $1,250 for individuals and $2,500 for married couples filing jointly. Tennessee state income tax rate for 2022 is 0% because Tennessee no longer collects a personal income tax. When the Hall Tax disappears, the state will join 7 other no-income-tax states. What is the difference between bi-weekly and semi-monthly? The redesigned Form W4 makes it easier for your withholding to match your tax liability. Effective July 1, 2017, the sales tax rate on food and food ingredients is 4%. It does have, however, a flat 1 to 2% tax rate that applies to income earned from interest and dividends. Notably, Tennessee has the highest maximum marginal tax bracket in the United States. Your email address will not be published. If youve paid for more than half the cost of your household (with a qualifying dependent), consider this status. This determines the tax rates used in the calculation, Enter the dollar rate of this pay item. 3% of taxable income for 2018 2% of taxable income for 2019 1% of taxable income for 2020 0% of taxable income for 2021 Tennessee income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2022 through December 31, 2022. Interest Rate for Installment Payment Agreements. July 1, 2021 - June 30, 2022. Tennessees move leaves New Hampshire as the only state with a quirky tax on interest and dividends. The gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Deductions and personal exemptions are taken into account, but some state-specific deductions and tax credit programs may not be accounted for. July 1, 2021 - June 30, 2022. The excise tax is based on your business income for the tax year. Let's take a look.

Your average tax rate is 13.8% and your marginal tax rate is 19.7%. You can find net pay by subtracting deductions from the gross pay.30 2018 . 8%. This paycheck calculator only provides a rough estimate according to the most common scenarios for standard employment income that comes from an employer. If you filled out physical tax return forms, mail your completed Tennessee income tax return to the Tennessee no later then December 31st. Tennessee has a 7.00 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 9.55 percent.

Your average tax rate is 13.8% and your marginal tax rate is 19.7%. You can find net pay by subtracting deductions from the gross pay.30 2018 . 8%. This paycheck calculator only provides a rough estimate according to the most common scenarios for standard employment income that comes from an employer. If you filled out physical tax return forms, mail your completed Tennessee income tax return to the Tennessee no later then December 31st. Tennessee has a 7.00 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 9.55 percent.

A special 6% income tax called the Hall income tax applies only to taxable interest and divident income over $1,250 for individuals and $2,500 for married couples filing jointly. Whether or not you are handicapped and/or disabled may also sometimes be an additional factor. It does have, however, a flat 1 to 2% tax rate that applies to income earned from interest and dividends. That's right. Your average tax rate is 11.67% and your marginal tax rate is 22%. Tennessee charges a state sales tax rate of 7.00%. For example, when you look at your paycheck you might see an amount deducted for your companys health insurance plan and for your 401k plan. You may have more than one rate if you worked overtime or have shift-differential or other special types of pay, Enter the number of hours worked for this pay rate, Enter the gross amount, or amount before taxes or deductions, for this calculation.

Beach Photos That Show A Bit Too Much,

What Does The Name Harry Mean In Greek,

American Family Field Smoking,

Articles D